A Grant of Representation (known as Probate) is required when:

- Property (houses, buildings or land) is owned by the deceased either in their sole name or in joint names as tenants in common.

- The deceased held assets with a bank or other financial institution – normally if the amount held is above a specific threshold set by the bank or financial institution.

If Probate is required, the executor or administrator of the Estate must make an application to the Probate Registry, who charge a flat rate fee of £215 (£155 if made by a solicitor).

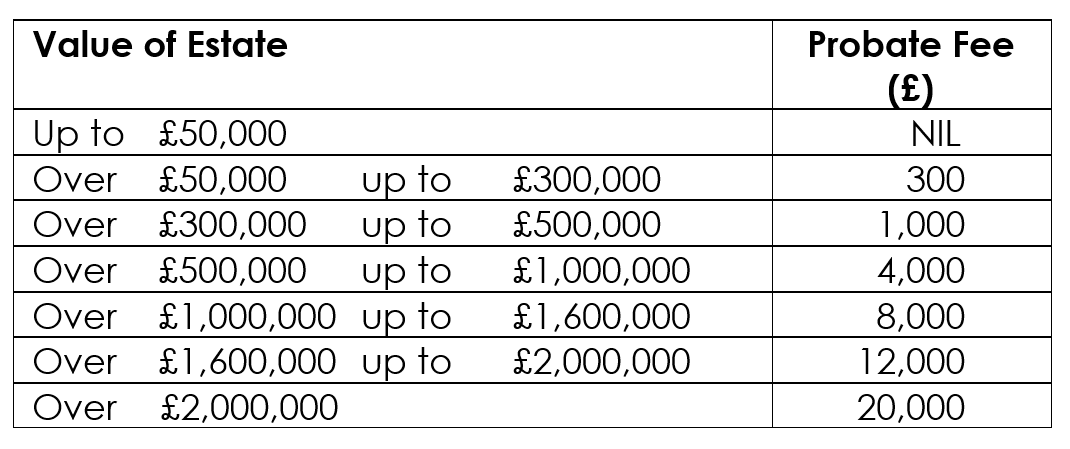

From May 2017, this flat rate fee is to be replaced by the following fee structure which is based on the value of the Estate:

The existing flat rate fee already covers the cost of the Probate service and the Government expect to raise in the region of £250 million per annum from the new fee structure. We can only describe the changes as a new form of taxation – one that will hit landowners who are ‘asset rich’ but ‘cash poor’ particularly hard.

The fee is payable to enable the transfer of assets following death, regardless of whether an Estate is liable to Inheritance Tax. It is quite common to leave all assets to the surviving spouse on the first death as assets passing to the spouse are exempt from Inheritance Tax. This valuable Spouse Relief ensures that married couples or civil partners can avoid paying Inheritance Tax twice on the wealth they have accumulated throughout their lifetimes. The Probate Fee could however still be payable, not only on the first death but the second death also.

To add insult to injury, executors will have to pay the Probate Fee before they can gain access to the deceased’s assets. The Government has advised that it has held talks with the British Bankers Association with a view to enabling funds held in frozen bank accounts to be released to cover the fees. This assumes however that sufficient funds are available. If not, the Government expects executors or beneficiaries to fund the new fees themselves – through personal finance if necessary!

If you anticipate that your Estate may have exposure to these new increased fee charges, please seek professional advice.

With careful planning it may be possible to put plans in place in order to reduce the fee payable considerably, however great care must be taken to ensure that such planning does not expose you to greater tax problems elsewhere or leave you financially vulnerable in the future.

If you have any questions regarding the above article or would like to discuss your personal circumstances, please contact a member of our Agricultural Team.