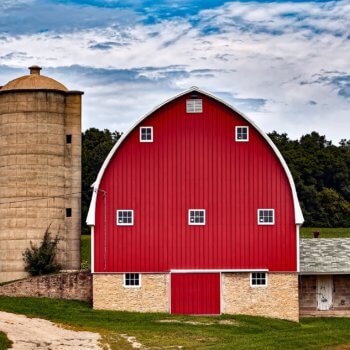

Structures and Buildings Allowance

Since the government abolished the agricultural buildings allowance in 2011, there has been little if any tax relief available on the construction of new fam buildings…until now! A new structures…

Since the government abolished the agricultural buildings allowance in 2011, there has been little if any tax relief available on the construction of new fam buildings…until now! A new structures…

In January 2018, Chancellor Phillip Hammond commissioned the Office of Tax Simplification (OTS) to carry out an extensive review of the current Inheritance Tax (IHT) regime. On 23 November 2018,…

The judge in a recent High Court hearing has ruled on a dispute between two farming brothers over what constituted partnership property following the death of their father. Two brothers,…

We are often asked by our farming clients whether they can recover the input VAT incurred on their rented farm cottages or other residential properties. The answer is not a…

Landowners can receive very favourable Inheritance Tax (IHT) treatment in respect of the value of their farming assets if they are actively involved in a farming trade. On death it…

The rate of Inheritance Tax (IHT) applied to a person’s Estate on death is 40% on all chargeable assets above a certain threshold, the nil rate band. Business assets and…

What is it? Rollover Relief is a Capital Gains Tax (CGT) relief which may apply if you sell certain business assets and use all or part of the proceeds to…

The RDPE Countryside Productivity Scheme provides funding for projects in England which improve productivity in the farming and forestry sectors and help create jobs and growth in the rural economy….

Making Tax Digital (MTD) was initially scheduled to be rolled out nationwide from April 2018 for the majority of unincorporated businesses and landlords, however on 13 July 2017, the Government…

Building a new farmhouse or converting an old barn into residential property is generally not considered part of the farm trading activity, therefore VAT incurred on such projects cannot normally…